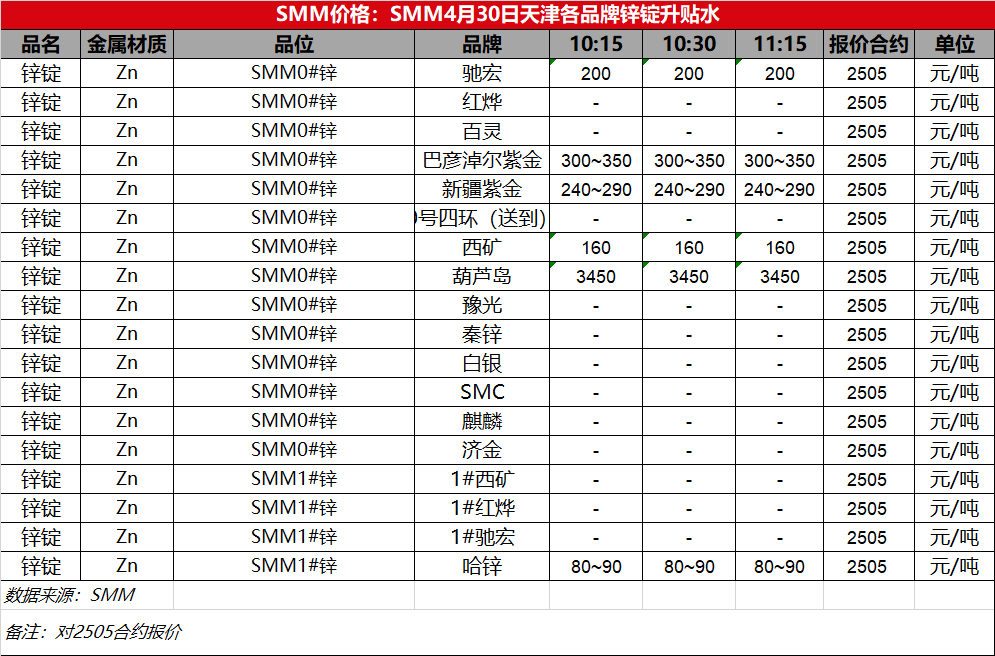

SMM April 30 News: In the Tianjin market, mainstream transactions for #0 zinc ingot were concluded at RMB 22,860-23,110/mt, with Zijin transactions at RMB 23,000-23,170/mt. Transactions for #1 zinc ingot were around RMB 22,580-22,710/mt, while Huludao reported prices at RMB 26,270/mt. Regular #0 zinc ingot was quoted at a premium of RMB 160-290/mt against the 2505 contract, with Zijin quoted at a premium of RMB 300-350/mt against the 2505 contract. The Tianjin market was quoted at a premium of approximately RMB 40/mt against the Shanghai market, with the price spread between the two markets narrowing. By the close of the morning session, Xinzhi was quoted at a premium of RMB 240-290/mt against the 05 contract, Xikuang was quoted at a premium of RMB 160/mt against the 05 contract, and Chihong was quoted at a premium of around RMB 200/mt against the 05 contract. High-end brand Zijin was quoted at a premium of approximately RMB 300-350/mt against the 05 contract. On the last day before the holiday, the futures market was mainly characterized by volatile trading. Downstream enterprises had largely completed their inventory build-up for the upcoming Labour Day holiday, and were either picking up goods or awaiting the arrival of new long-term contracts. Additionally, downstream enterprises were generally closed for 2-3 days, resulting in low overall purchase willingness. Traders continued to lower premiums and discounts to facilitate sales, leading to a decline in premiums and generally moderate trading activity.